Serve customers better

Delight your customers with easy payments across the widest range of payment methods.

Grow your business

Get access to millions of customers who already use Amazon Pay.

Get rewarded

Earn incentives for driving transactions on Amazon Pay

Scan & Pay

Accept in-store payments from any payment app using Amazon Pay’s QR code. Get access to millions of Amazon customers & offer them additional rewards from Amazon Pay.

Amazon Pay Smart Stores

Let your customers experience the future of shopping. Accept seamless digital payment using any instrument including EMIs. Enable targeted rewards which can help you acquire, win-back customers and drive higher transaction share. Customise the storefront for your products to drive additional footfall. Click here to know more.

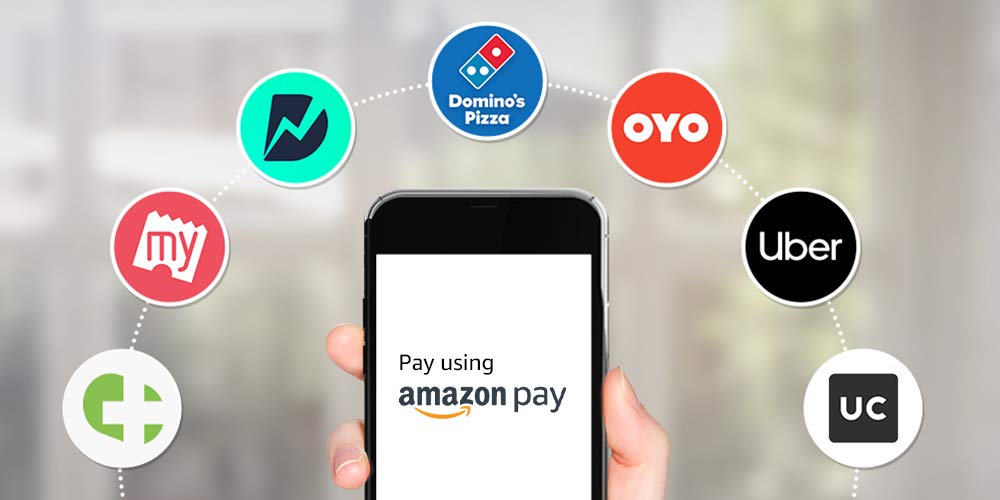

Online payments with Amazon Pay

Offer your customers a seamless and rewarding payment experience with Amazon Pay. They can use stored card details or make one-click payments using Amazon Pay balance. For partners wanting to integrate Amazon Pay on their website/app, write to us at amazonpay-in-sales-queries@amazon.com

Amazon Pay Corporate Gift Cards

The perfect gift for employee rewards, client or channel partner gifting, customer promotions, festival gifting, sales incentives and more business occasions. These can be used for shopping, bill payment, recharges, and payment on 1000+ Amazon partner apps.